Minnesota Life Insurance Company, a subsidiary of Securian Financial Group, has a long history of providing trusted insurance solutions. With high ratings and a commitment to customer service, it's a reliable choice for comprehensive financial security.

Jeff Rose, CFP® Jeff Rose, CFP® is a Certified Financial Planner™, founder of Good Financial Cents, and author of the personal finance. Read More

The GFC® Money Expert Review Board The GFC® Money Expert Review Board is a team of financial experts who provide independent, unbiased reviews of financial products. Read More

Advertising Disclosure GoodFinancialCents® has an advertising relationship with the companies included on this page. All of our content is based on objective analysis, and the opinions are our own. For more information, please check out our full disclaimer and complete list of partners.

Quality VerifiedGoodFinancialCents® partners with outside experts to ensure we are providing accurate financial content.

These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism.

Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments.

Why You Can Trust GoodFinancialCents®GoodFinancialCents® partners with outside experts to ensure we are providing accurate financial content.

These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism.

Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments.

While Minnesota Life did not make the Good Financial Cents® top 9 life insurance companies it did get an honorable mention and we have had great success working with this company.

Since 1880, Securian Financial Group has been the holding company and parent of Minnesota Life Insurance Company and Securian Life – as well as their affiliates.

This financial powerhouse specializes in working with employers to offer financial, retirement, and insurance plans to their employees.

And, for more than 80 years, Minnesota Life Insurance Company has provided businesses with customized solutions to their employee benefit needs, as well as expertise in administering large public and private employer plans to small and medium-sized municipal employers.

This insurer also offers individual insurance options.

This insurance company insures more state plans than any other group insurer. It also counts 20 percent of the Fortune 100 companies as its clients. Also, it is proud to offer industry-leading technology, such as the first mobile-optimized website for group insurance transactions.

The unique brand of service that is provided by Minnesota Life Insurance Company has established the company as a valued partner and a premier provider in the group insurance coverage arena.

Just some of the quality and exceptional service that Minnesota Life Insurance is known for include the following:

Its parent company, Securian, is also considered to be strong and stable. Securian has nearly 15 million customers, and more than 5,000 associates and representatives in its headquarters in St. Paul, Minnesota, as well as in sales offices around the country.

Also, the company has more than $1 trillion of insurance in force, and in just the year 2014 alone, it paid out more than $4 billion in benefits to its customers.

The parent company of Minnesota Life Insurance Company, Securian, has been provided with extremely high ratings from the insurer ratings agencies. These include:

Minnesota Life Insurance Company offers both term and cash-value life insurance policies. Life insurance policies are individual and group in nature.

For the group plans that are offered, regardless of whether these are offered as basic or as voluntary plans, group life insurance products are considered to be the mainstay of most employee benefits programs – and Minnesota Life Insurance Company provides them all.

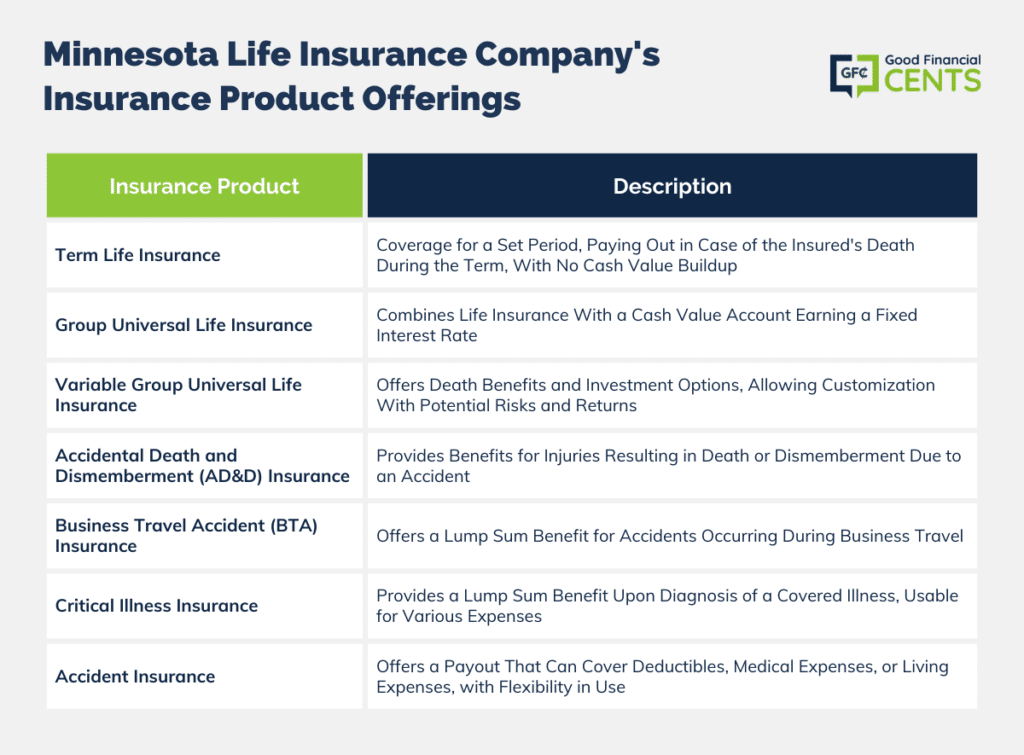

Group life insurance products that are offered through Minnesota Life include the following:

With a variable group universal life insurance policy, the investment “sub-accounts,” there can be both potential risks and rates of return so that employees may “customize” their investments to meet their specific financial goals.

These investments can fluctuate, and when they are redeemed, they may be worth more or less than the amount that was initially invested by the employee. These plans may be designed to include a guaranteed account that offers a fixed rate of return that is guaranteed never to fall below three percent.

The guarantees for the guaranteed account are based only on the financial strength and claims-paying ability of Minnesota Life Insurance Company, which are important. However, this has no bearing on the performance of the individual investment options.

In addition to term and permanent life insurance coverage, accidental death, and dismemberment (AD&D) insurance protection, accident insurance, and critical illness insurance to both large employers and executive groups across the nation, this insurer also partners with Zurich International Life in order to provide group life insurance coverage for global employees.

Individual annuities are also offered by Minnesota Life Insurance Company.

These can help individuals to ensure that they will have an income for the remainder of their lives, by paying out a guaranteed income stream on a regular basis, regardless of how long the person lives. Also, retirement plans are also offered through Minnesota Life Insurance Company.

They have an IncomeToday! Annuity, which is an immediate income annuity (as you can probably guess from the name). With these annuities, you pay one lump sum and then you’ll start receiving paychecks immediately.

If you’re getting close to retirement, you might be worried about having enough money, but that’s where these annuities come in.

Aside from the immediate paycheck, there are several other annuity options that you can choose. One popular is a fixed indexed deferred annuity. These are annuities that are based on the performance of the markets.

That means that these annuities are going to give you a guaranteed income, but there is a chance that they could earn you much more.

Another type of annuity that you can choose to supplement your retirement income is variable deferred annuities. When you invest in a variable deferred annuity, there are several options for investing your money.

The investment options of the annuity can reflect your risk tolerance and you can change the investments as you get closer to retirement.

Through the parent company of Minnesota Life Insurance Company, Securian, there are many additional insurance and financial products that are offered, too. These include retirement plans, investments, and executive benefits.

Because employers are this company’s key market, Securian works with groups in identifying the right plan types for their needs – from profit sharing and 401(k)s to defined benefit and cash balance plans.

The 401(k) plan design options are based primarily on employer goals, as well as the budget and demographics of the particular employer.

Investment options can be selected from more than 5,800 unique investment options, and investment allocation portfolios are based on age or risk tolerance. Profit sharing and matching contribution components are also available.

While few employers offer defined benefit plans today, Securian helps companies differentiate themselves and offer their employees the security of knowing that they’ll have an income for life with a pension income.

Regardless of how the investments in the plan perform, the participants in this type of plan will be able to still receive a set amount of retirement income.

Cash balance plans are also available through Securian. These types of plans can help an employer to essentially bridge the gap between a traditional defined benefit plan and a defined contribution plan such as a 401(k).

The qualified plan products that are offered by Securian are done via a group variable annuity contract that is issued by Minnesota Life Insurance Company.

While the company (Securian) works with employers of all sizes, it specializes in plans that have assets up to approximately $200 million.

Navigating through the rich history and diverse offerings of Minnesota Life Insurance Company and its parent, Securian Financial Group, unveils a legacy of unwavering financial stability, innovative solutions, and a dedicated client-centric approach.

Holding impeccable ratings from leading rating agencies, the company not only stands out in delivering a myriad of group and individual life insurance products but also excels in facilitating retirement solutions and annuities, ensuring comprehensive financial security.

The company’s commitment, demonstrated through rapid claim payouts and a stalwart customer service ethos, further consolidates its position as a reliable, albeit not infallible, insurance and financial ally for both individual policyholders and employer groups, sustaining a tradition of safeguarding futures against an ever-shifting financial landscape.

How We Review Insurance Companies

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability.

Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation.

Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Minnesota Life Insurance Company

Product Description: Minnesota Life Insurance Company, a powerhouse subsidiary of Securian Financial Group, specializes in providing a versatile range of life insurance products and retirement solutions tailored to both individual and group clients. With a notable reputation for delivering robust group insurance plans to employers and an impressive suite of individual insurance and annuity options, the company stands out for its dedication to financial security and client well-being.

Summary

Diving deeper, Minnesota Life offers an encompassing spectrum of life insurance options, including term and cash-value policies, designed to cater to diverse financial needs and stages of life. For groups and employers, the company unfolds a variety of products, such as group term life, universal life, and accidental death & dismemberment insurance, seamlessly integrating financial protection with employee benefits. Simultaneously, individual clients find solace in its array of personalized solutions, from immediate annuities ensuring a consistent income stream post-retirement, to variable deferred annuities allowing investment in line with risk tolerance. The comprehensive offerings, paired with Minnesota Life’s steady financial footing, embody a holistic approach to financial planning and security for a wide array of client demographics.